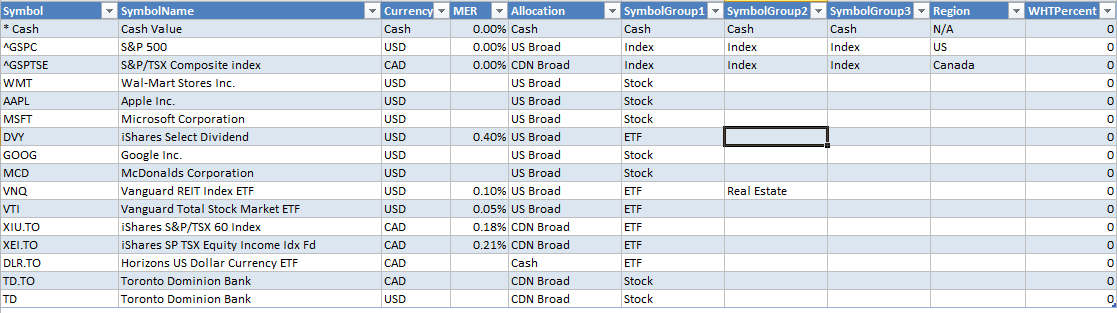

Symbol Table

"Symbol" table is located in Portfolio Slicer workbook "srcSymbol" worksheet. This table should have one record for each investment you have. Please leave first record for symbol "* Cash" unchanged.

What you use as "Symbol" should match exactly "Symbol" column in Quotes.csv file. So really "Symbol" will depend on your quotes source provider - you will have to match them exactly. Lets say you have "Toronto Domininion Bank" investment traded in Toronto Stock Exchange. If your Quote provider is Yahoo Finance, then your symbol would be "TD.TO". But if you get quotes for the same symbol from Google Finance website, then your symbol would be "TSE:TD". And if you get quotes from some other financial data company, same symbol could be "TD:TSE" or "Toronto:TD". Most USA stocks/ETFs would have no suffix/prefix, so they would be the same with majority of quote providers.

Table Symbol has multiple columns:

It is critical for you to enter Symbol and Currency and Allocation information, all other information could be left blank at first and updated later.

Columns in "Symbol" Table:

- Symbol - Your investment short code/symbol/ticker. Should match exactly "Symbol" column in Quotes.csv file.

- SymbolName - Name of the symbol.

- Currency - symbol currency. Must match one of the values in "Report Currency" table, otherwise background will be red and calculations might not work properly.

- MER - Management Expense Ratio. Must be numeric value expressed in percents. Example: 0.40%. This information is used to calculate approximate amount you pay as fees (hidden to you) for mutual fund or exchange traded fund management.

- Allocation - symbol assigned allocation. Must match one of the values in Allocation table, otherwise background will be red.

- SymbolGroup1 - custom grouping field.

- SymbolGroup2 - custom grouping field.

- SymbolGroup3 - custom grouping field.

- Region - region that you want to assign this symbol to. This value could be used for custom grouping.

- WHTPercent - Withholding tax percent. Example: 20 - means that 20% of dividend received is assumed to be withheld as tax.

Please remember to include Market Index symbols you specified in "Config" table.