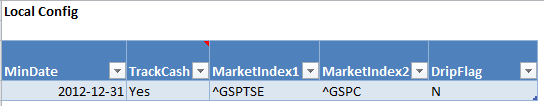

Config Table

Table "Config" is located in Portfolio Slicer "src" worksheet and should be the first table that you will enter data into. This is very simple table that has just 5 parameters:

Here is detail explanation of each parameter:

- MinDate - date from when you want to start tracking of your investments. This date value should be in format YYYY-MM-DD. This date should match earliest Date generated in your externally generated 4 files. In Excel workbook this parameter is used just to check if dates in Transactions table are after this MinDate - if before, these dates will have red background. More information on choosing right value for this parameter you can find at the bottom of this page.

- TrackCash - If value for this parameter is set to "Yes", then Portfolio Slicer will track cash - that is it will calculate "CashBalance" column value in "Transactions input table (worksheet srcTrans) and will calculate "Cash Value" and related measures in Portfolio Slicer reports. So if you want to track cash, then before buying investment you need to deposit cash; when you buy investment, then amount is deducted from your cash balance; when you sell investment or receive dividend payment - that amount is added to your cash balance. In Portfolio Slicer reports measure "Total value" will be equal to "Equity Value" + "Cash Value". When you track cash you can match Portfolio Slicer data with your investment institution data up to exact cent. As tracking of cash requires a bit more transactions, you can choose first to set this parameter value to "No", then when you will figure out Portfolio Slicer basics, you can switch this parameter to "Yes" and start adding cash related transactions.

- MarketIndex1 - symbol for Market Index that you will want to compare you investment performance to. Portfolio Slicer has report that compares your investment performance to 2 different market indexes from this config file. Default value for this parameter is "^GSPTSE" - that is "S&P/TSX Composite index", a well known Canadian stock market index.

Important: any symbol you specified here should also be included into Symbol table and should also be included in Quote table. - MarketIndex2 - symbol for Market Index that you will want to compare you investment performance to. Portfolio Slicer has report that compares your investment performance to 2 different market indexes from this config file. Default value for this parameter is "^GSPC" - that is "S&P 500", a well known USA stock market index.

Important: any symbol you specified here should also be included into Symbol table and should also be included in Quote table. - DripFlag - at this point this parameter is not used, so please ignore it.

Choosing MinDate value

It is important to choose right date from when you want to start track your investments. At first you should decide for how many years you are ready to enter transaction data into Portfolio Slicer. You might choose to enter just buy/sell transactions for some older years and accept that reported performance will not include dividend payment information. You might also choose later to add dividend payment information even for older years. So we recommend that you add at least 3-5 years of your investment transaction information. If you will choose to track performance for last 4 years, then we recommend that MinDate value would be last business day of the year 5 years ago.Example: If now is Feb of 2016 and you want 4 years of historical data, then you should choose MinDate as 2011-12-30. With such choice you will have data for full years from 2012 up to 2015. In such setup for 2011-12-31 you should enter buy transaction for all holdings at that point in time with cost basis override of actual value. This way your performance calculations starting from 2012 will be accurate.